Figures confirm that 2021 was a banner year for merger and acquisition activity in the North American wealth management sector, with 307 deals, a rise of almost 50 per cent from the 205 transactions chalked up a year earlier.

The data from ECHELON Partners, an investment bank and advisory firm focused on wealth management, said there were 145 acquisitions of firms with more than $145 billion in assets – the most in a single year. All told, $576 billion of assets changed hands in 2021.

Rising regulatory costs and client expectations are driving demand for economies of scale while owners of firms nearing retirement age are also planning to sell up. The past few months have also seen a number of multi-family office deals in addition to those of registered investment advisors, although RIAs dominate activity. There are some concerns about whether all deals are wise . We have also looked at some big deals in the MFO space, notably last year's combination of Tiedemann Group and London-based Alvarium Investments.

Private equity capital continues to be the most active force in wealth management M&A. Whether it is establishing platforms focused on consolidation, conducting add-on acquisitions, or providing growth capital to wealthtech start-ups, there is “significant” interest from this group, ECHELON Partners said in its annual review. Private equity was directly or indirectly involved with over two-thirds of all deal activity in 2021.

The report said that while a desire by firms’ owners to hand over the reins drove most buyouts in 2021, there is also growing demand for deals in which a buyer takes a minority stake in a business. Such transactions rose by 58 per cent in 2021 from a year before.

“Despite macroeconomic risks , we expect continued demand for wealth management M&A from industry participants. Our 2022 outlook details reasons for our bullish view as well as other trends we expect to see in another exciting year of dealmaking,” Dan Seivert, managing partner and chief executive at ECHELON Partners, CEO, said.

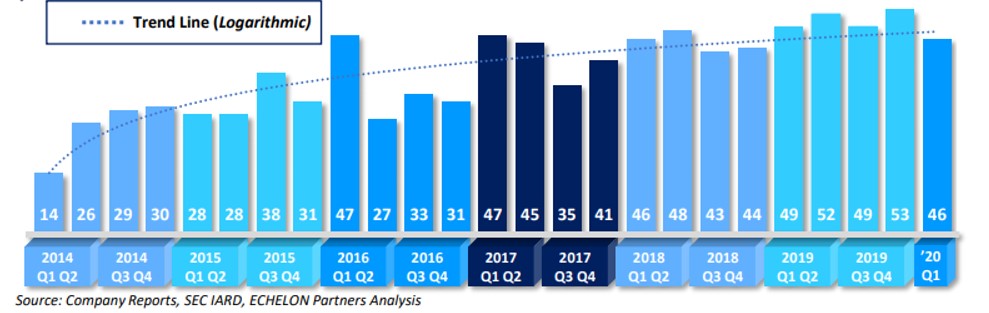

Source: ECHELON Partners

“Financial acquirers have traditionally been the most active buyers of firms with over $1 billion in AuM. While they continue to be quite active in this space, financial acquirers face increased competition from strategic acquirers and consolidators that are looking upmarket and actively acquiring $1 billion+ firms. This competition has led to favorable valuations and deal structures for sellers that have taken notice and entered the market, helping drive deal volume in this segment higher. Despite the increased competition, financial acquirers remain the most dominant buyer type for the largest firms in the wealth management market, frequently announcing $10 billion+ AuM deals,” the report continued.

One of the stand-out acquirers of recent years has been Canada-based CI Financial, which has bought scores of US wealth management firms.